StarProperty.my had recently conducted a survey to measure house buyers’ sentiment on the national economy and the property market for the years 2015/2016. House buyers’ sentiment on the present and future state of the national economy and the national property market, as well as the present and future impact on house buyers’ cost of living and ability to purchase properties, were pessimistic.

Based on a sample size of 935, a substantial number of respondents were pessimistic about the present state of the national economy. The breakdown in results are as follows: 9.4% (very pessimistic), 36.8% (pessimistic), 40.2% (neutral), 12.3% (optimistic), and 1.3% (very optimistic).

Similar expectations for the future state of the national economy within the next one year prevailed. The breakdown in results are as follows: 9.5% (very pessimistic), 36.8% (pessimistic), 33.5% (neutral), 18.1% (optimistic), and 0.8% (very optimistic).

Sentiment for the present state of the national property market appeared to be marginally better, compared to sentiment for the present state of the national economy. This result is in spite of the fact that sentiment for the present state of the national property market was pessimistic. The breakdown in results are as follows: 7.7% (very pessimistic), 32.0% (pessimistic), 39.9% (neutral), 18.5% (optimistic), and 1.9% (very optimistic).

Sentiment for the future state of the national property market within the next one year appears to be improving, even though sentiment remains pessimistic. The breakdown in results are as follows: 12.6% (very pessimistic), 24.6% (pessimistic), 36.0% (neutral), 23.1% (optimistic), and 3.7% (very optimistic).

A significant majority of respondents have had their cost of living impacted by the present state of the national economy. The breakdown in results are as follows: 38.7% (severe impact), 56.1% (moderate impact), and 5.2% (no impact).

When compared to the present, expectations of the future impact, within the next one year, on the cost of living, were pessimistic. The breakdown in results are as follows: 9.8% (very pessimistic), 42.0% (pessimistic), 32.0% (neutral), 14.1% (optimistic), and 2.1% (very optimistic).

While pessimistic respondents outweigh optimistic respondents approximately two-to-one, almost half of the total number of respondents were neutral in sentiment, in respect of their present ability to purchase properties. The breakdown in results are as follows: 8.7% (very pessimistic), 27.2% (pessimistic), 45.7% (neutral), 16.5% (optimistic), and 1.9% (very optimistic).

Interestingly, both optimism and pessimism rose in sentiment for buyers’ future ability to purchase properties within the next one year. The breakdown in results are as follows: 9.2% (very pessimistic), 29.4% (pessimistic), 38.3% (neutral), 20.1% (optimistic), and 3.0% (very optimistic).

Respondents’ profiles

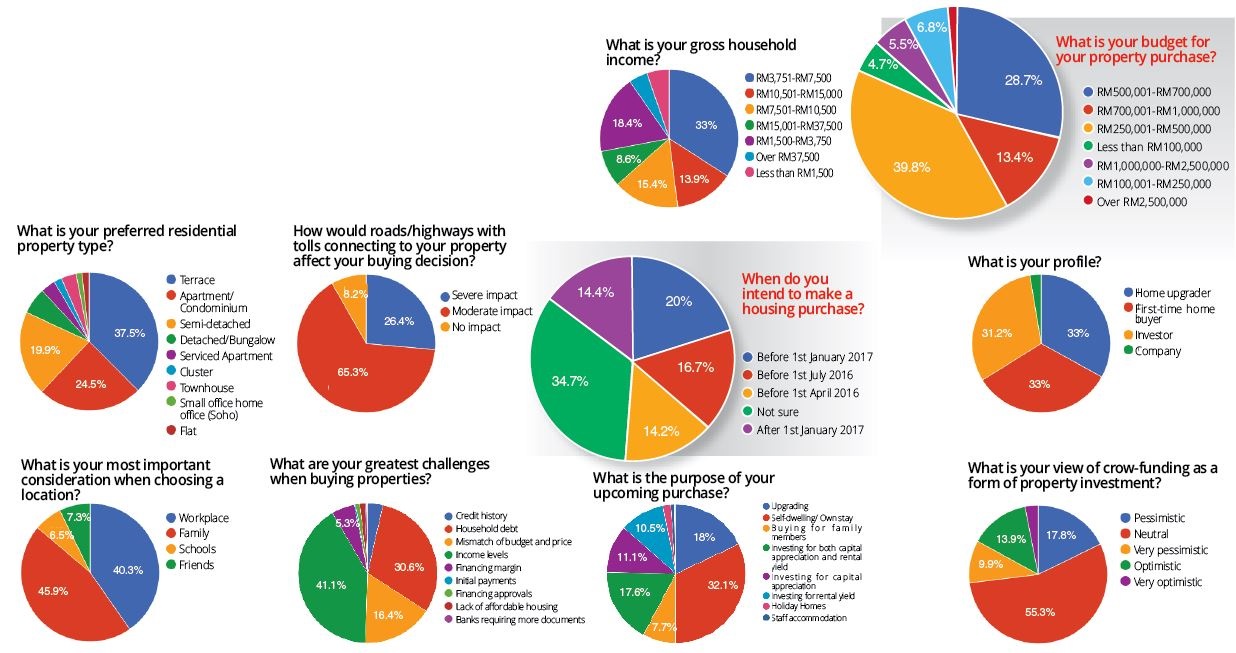

The survey found that the majority of respondents had a gross household monthly income of RM1,500 to RM7,500. The breakdown in results are as follows: 18.4% (RM1,500 to RM3,750), 34.1% (RM3,751 to RM7,500), 15.4% (RM7,501 to RM10,500), 13.9% (RM10,501 to RM15,000), 8.6% (RM15,001 to RM37,500), and 9.6% (less than RM1,500 and over RM37,500).

The majority of respondents were found to have budgets of RM250,000 to RM700,000 for their property purchase. The breakdown in results are as follows: 4.7% (less than RM100,000), 6.8% (RM100,001 to RM250,000), 39.8% (RM250,001 to RM500,000), 28.7% (RM500,001 to RM700,000), 13.4% (RM700,001 to RM1,000,000), 5.5% (RM1,000,001 to RM2,500,000), and 1.1% (over RM2,500,000).

Kuala Lumpur and Selangor were the most preferred states in the search for properties for the majority of respondents. The breakdown in results are as follows: 53.7%% (Wilayah Persekutuan Kuala Lumpur), 33.9% (Selangor), and 12.4% (others).

The top three preferred residential property types by responders are terrace, apartment/condominium, and semi-detach. The breakdown in results were as follows: 37.5% (terrace), 24.5% (apartments/condominiums), 19.9% (semi-detach), and 18.1% (others).

Roads and highways with tolls connected to properties would have an impact on respondents’ buying decisions. The breakdown in results were as follows: 8.2% (no impact), 65.3% (moderate impact), and 26.4% (severe impact).

Family and workplace are the most important considerations for most of the respondents when they are choosing a location for their properties. The breakdown in results were as follows: 45.9% (family), 40.3% (workplace), 7.3% (friends), and 6.5% (schools).

Based on the survey results that were compiled, StarProperty.my found that income levels, household debt, and mismatch of budget and price were the top three factors that posed the greatest challenges when buying properties for respondents. The breakdown in results were as follows: 41.1% (income levels), 30.6% (household debt), 16.4% (mismatch of budget and price), 5.3% (financing margin) and 6.6% (initial payments, financing approvals, lack of affordable housing, banks requiring more documents, and credit history).

More than half of the respondents have expressed their intention to make a housing purchase within the year 2016. The breakdown in results were as follows: 14.2% (before 1st April 2016), 16.7% (before 1st July 2016), 20% (before 1st January 2017), 14.4% (after 1st January 2017), and 34.7% (not sure).

Respondent profiles for this survey were almost equally apportioned to home upgraders, first-time home buyers, and investors. The breakdown in results were as follows: 33% (home upgrader), 33% (first-time home buyer), 31.2% (investor), and 2.8% (company).

Survey respondents were primarily interested to purchase a residential property for self-dwelling, upgrading, and investing. The breakdown in results were as follows: 32.1% (self-dwelling/own stay), 18.0% (upgrading), 17.6% (investing for both capital appreciation and rental yield), 11.1% (investing for capital appreciation), 10.5% (investing for rental yield), 7.7% (buying for family members), and 3.0% (holiday homes, staff accommodation, and others).

Sentiment for crowd-funding as a form of property investment is primarily neutral with pessimistic tendencies. The breakdown in results were as follows: 9.9% (very pessimistic), 17.8% (pessimistic), 55.3% (neutral), 13.9% (optimistic), and 3.1% (very optimistic).

In view of the current sentiment among house buyers, it is important for various stakeholders of the property market, including authorities, developers, real estate professionals and financial institutions, to address the challenges faced by house buyers and enable them to buy houses.

Source : starproperty.my